H&R Block

Everything counts.

Q: How do you make H&R Block the go-to tax pros for small businesses?

A: You celebrate the chaos of running a small business by telling the story behind every expense.

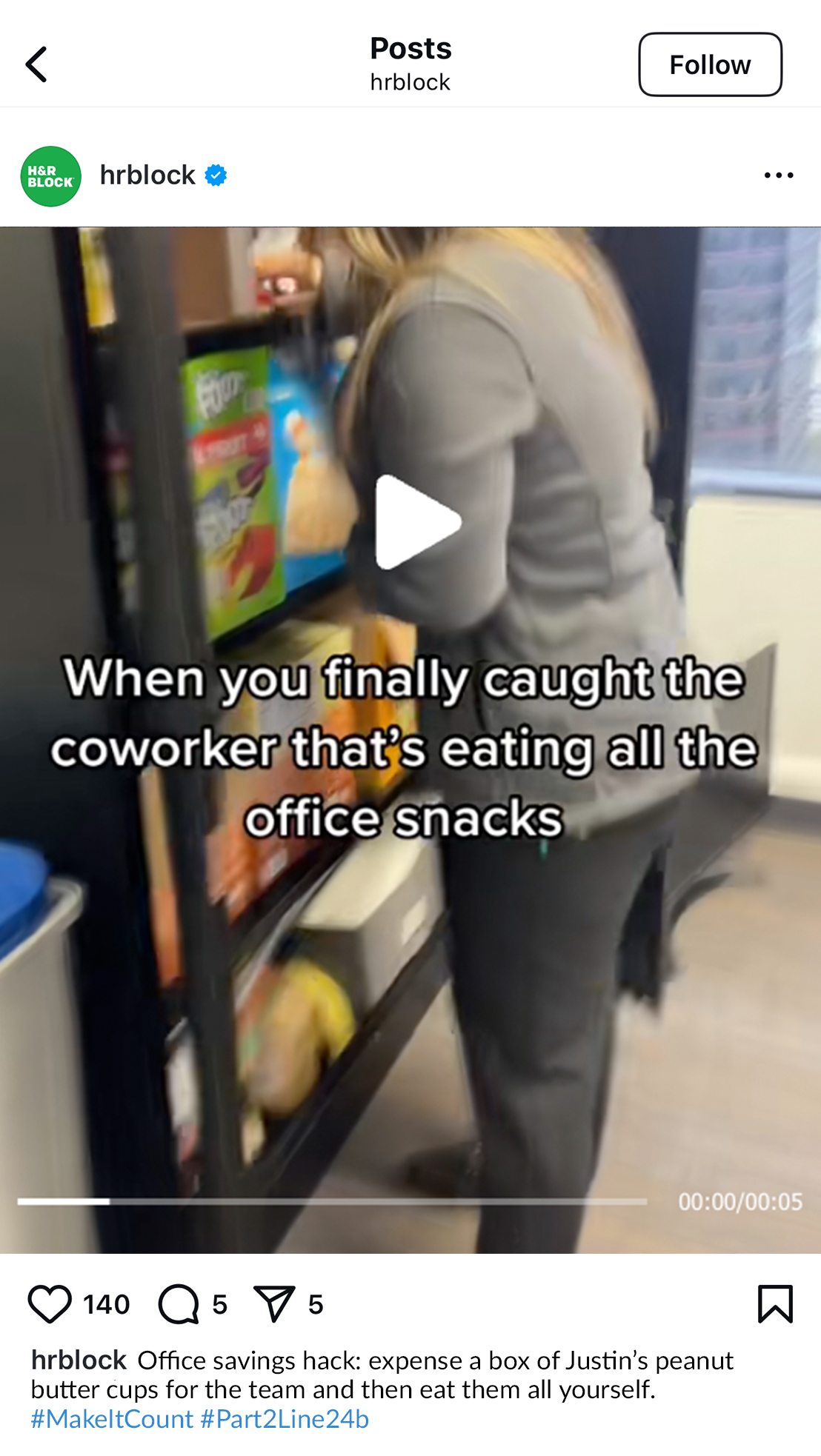

Social Posts (15 seconds)

Showcasing H&R Block’s 70-year history making small business deductions count, no matter what they are.

Digital

The $25 Deductible Gift Shop

Since 1962, the IRS has allowed businesses to deduct only up to $25 per recipient per year on business gifts. Small businesses often rely on gifts to win new customers, clients, vendors, consultants, freelancers, and contractors. Corporate discounts shouldn’t be limited to big corporations.

H&R Block will offer account customers exclusive access to a “$25 Write-Off Shop” selling a revolving array of business gifts valued at $25, perfect for staying within the deductible limit and making every dollar count.

$25 Tax-Deductible Gifts

$25 Deductible Desk Survival Kit

Kits may include gum, stress balls, lip balm, sanitizing wipes, essential oil, and a “Do Not Disturb (unless it’s snacks)” door hanger.

$25 Deductible Plant Block

“Grow your business” - and your deductible.

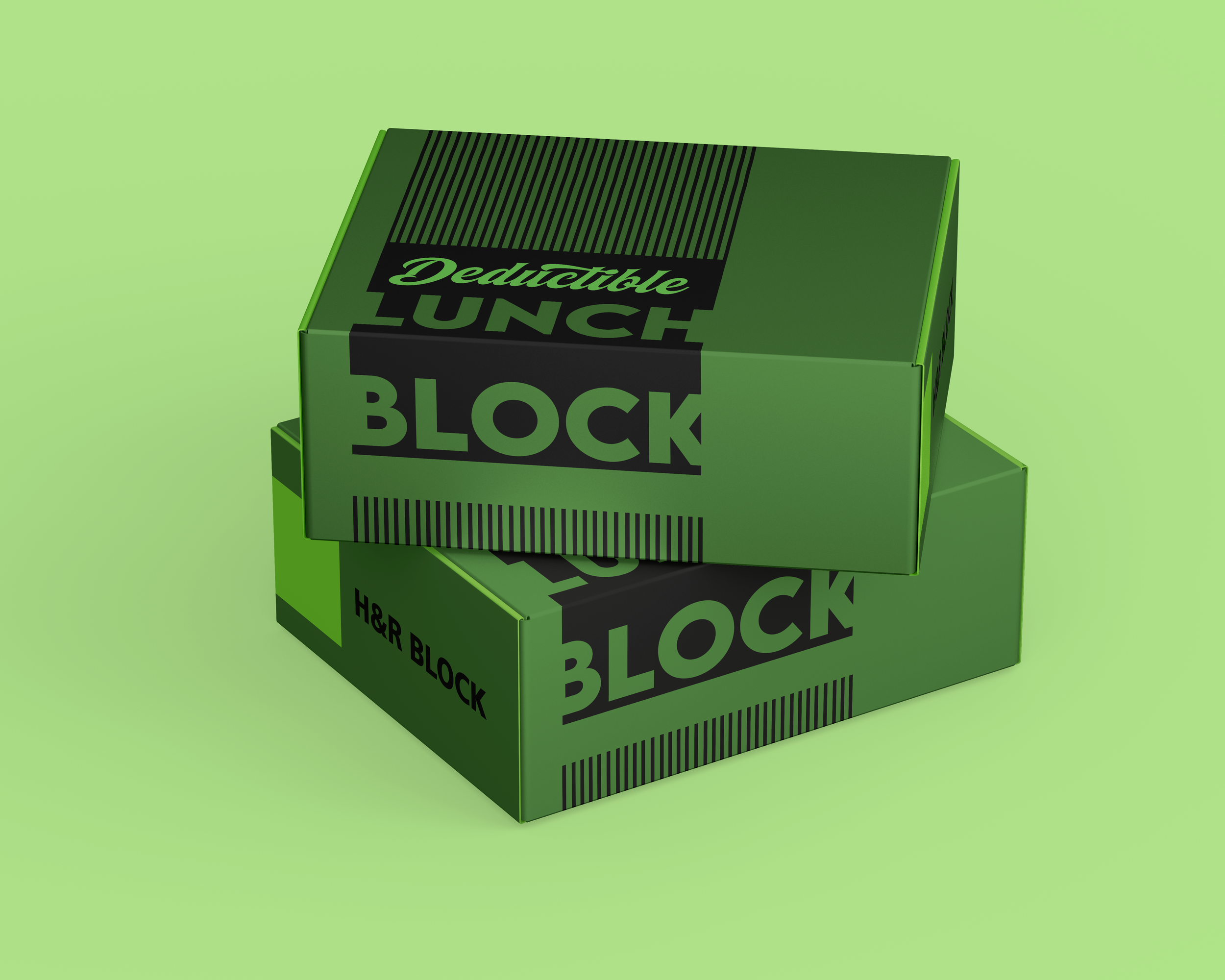

The Deductible Lunch Block

While there’s no such thing as a free lunch, H&R Block will offer deductible “lunch blocks” to customers while they file their taxes at the physical store. Small business owners can deduct these as qualifying “business meals.”

$25 Deductible Meeting Recovery Candle Block

Smells like this could’ve been an email.

Bonus: the process

![Wilhelmina Gerken [copywriter]](http://images.squarespace-cdn.com/content/v1/66e88b0d2dbc833f06eecd90/588e2444-35e9-4c78-b3ca-3552548871ae/new+logo+5.png?format=1500w)